Executing client orders with best efforts is critical. This is where Wealth Management firms (“Wealth Managers”) must live up to the trust placed in them by their clients. Once the order is executed and the portfolio set-up in the system, ongoing monitoring should be frictionless unless the client wishes to make changes. Wealth Managers could also offer dynamic updates to the portfolio to protect it from downside risk due to massive volatility, but this comes at a cost. For best experience and a smoother relationship, clients need to be offered Apps on which they can view their portfolio and make changes. APIs play a huge role in order execution and ongoing report generation making it seamless and cost efficient for Wealth Managers.

This is our 4th and final Part in our series of articles on the Benefits and Risks of APIs in Wealth Management (“WM”) with a focus on Order Execution and Portfolio Management and Reporting; however, the client lifecycle would not be complete if we did not touch upon Client off-boarding.

In Part 1, we considered the benefits and risks of using APIs to enhance client engagement - https://blueconnector.co/blog/2020-06-11-wealth-management-benefits-and-risks-of-apis.

In Part 2, we focused on the Client Onboarding phase - https://blueconnector.co/blog/2020-06-22-wealth-management-benefits-and-risks-of-apis-and-rpa-client-onboarding/.

In Part 3, we focused on the Investment Analysis and Advice phases - https://blueconnector.co/blog/2020-07-07-wealth-management-benefits-and-risks-of-apis-investment-analysis-and-advice/

Order Execution, Portfolio Management and Reporting

The client has selected the investments based on desired expected return for the acceptable risk level and risk profile, now all the Wealth Manager must do is execute the order on the market on best efforts. Well, this is true in theory; however, as complex as selecting right mix of asset classes and investment options are, executing orders for these is even more complex.

An element of complexity is the diversity of the investment asset classes and access to them. Equities are accessed via stock market and debt via the bond markets. If the offering to the client is about access to several markets around the world then this adds another layer of complexity. Derivatives such as futures, options, warrants, contracts for difference (CFDs) and other structured financing may also be available at certain exchanges and physical commodities need to be sourced through other markets. Alternative assets such as real estate, crypto currencies, SWAG (Silver, Wine, Art & antiques, Gold) are sourced from a wide variety of markets, but some exchanges are starting to offer crypto currencies.

Another contributor to complexity is the nature of the order execution, trade settlement for each asset class, deposits required to be retained with the exchanges and capital retained for potential margin calls. Some assets can be executed and settled intra-day, others 2-3 days and if the trade does not settle in time then there may be a requirement to post margin. Still other assets require extended periods of due diligence, document checks, and government approvals that can take weeks or months. All this needs to be tracked and monitored.

Wealth Managers can take one of two approaches or choose a mix of the two:

- DIY: Do It Yourself (all in-house).

- Partner ecosystems: Engage partners and intermediaries to handle some or most of the activities.

DIY (In-House) Execution

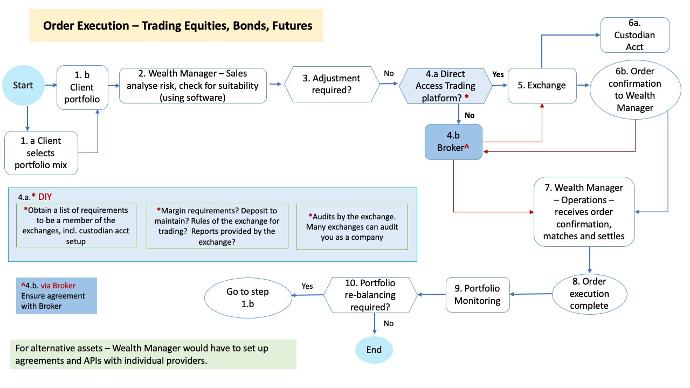

Do-It-Yourself (DIY) involves the Wealth Manager connecting directly with each exchange / market for the asset classes it chooses to offer clients.

Each exchange has different characteristics. For e.g., the New York Stock Exchange (NYSE) offers a broad and deep pool of investments in stocks, bonds, index funds and derivatives. It is also highly liquid: activity and trading volumes are high so that, at the right price, counterparties can readily be found for a trade. This is also true of other major exchanges such as NASDAQ, ICE, and LSE. Whilst smaller exchanges can offer a wide range of stocks, bonds, commodities, but the trading volumes might be lower; thus client’s investment requirements for diversity and liquidity may not easily match; however, the client might want products that are offered on the smaller / regional exchanges such as CSE or TSE for e.g. Wealth Manager would need to establish self-clearing agreements and membership with each exchange around the world to settle and clear their trades, not a light and easy task. It would also need to pay clearing fund deposit on each exchange which would tie up much needed capital. Some exchanges require self-clearing members to have a certain level of net worth. Membership requirements differs in each market and exchanges. Monitoring the arrangements for several markets would require dedicated resources.

To create efficiency, exchanges publish open APIs, which Wealth Managers and brokers could agree to use.

The Wealth Manager should consider several factors:

- Price of the equity / bond for e.g.

- Cost of the transaction

- Need for speed of execution

- Liquidity

- Settlement

- Other costs such as market effects, implicit transaction costs

- Feedback loop after the order is executed (either directly on a trading venue or via a broker)

If client orders are aggregated, the Wealth Manager should ensure that the aggregation will not disadvantage any individual client or be detrimental in terms of overall result. Executed aggregated orders are allocated amongst the clients using a transparent price methodology and to consider the best final price for the client. If the aggregated orders can only be executed partially, then pricing methodology for pro-ration is disclosed to the clients. APIs could be set up to provide full details of the executed order.

FinnHub.io for example provides APIs for stocks, currencies, and cyrpto-currencies. Detailed financial statements can be sourced by Wealth Managers from FinnHub.io as well. Larger Wealth Managers could source market data directly via APIs published by the exchanges, news agencies such as Refinitiv, Bloomberg, Xignite, IHS Markit to provide a consolidated view of the market.

Order Execution - DIY scenario

Below, illustration for the Order Execution flow in the DIY scenario with the 4.a path in the diagram

You can imagine establishing all the connections to exchanges and with various counterparties takes time and money. Whilst these interconnections are being established and regulatory approval obtained, the firm is not making any money. Once these connections are established, they need to be continually monitored. The key question to ask is what is your core business? Is it providing end-to-end service on your platforms and by your own resources? Resource management and training would need to extensive for DIY.

Partnering and Outsourcing

Alternative to DIY is to partner with, or outsource to, firms that can perform one or more steps in the execution workflow more efficiently and cost-effectively.

Incumbent Wealth Managers now are competing against new digital wealth management firms and with giant tech companies who are also establishing their own financial services arms to provide payment, wealth management and investment growth services. Joining one or more partner ecosystems would provide competitive advantage. A Wealth Manager could provide an integrated service and applications using their partner ecosystems; thus, enabling them to focus on the core services that are vital to their financial health and offer broader set of capabilities to meet client expectations.

Partnering with third party open ecosystem removes the need to have all in-house expert resources. Wealth Managers can look to offer traditional expertise in managing wealth and investments whilst co-innovating with fintech’s and technology partners for speed of delivery in a cost-effective manner. It would also allow Wealth Managers to develop fresh revenue streams by monetising data and through offering a wide range of investment products, access to global markets and innovative platform to millennials and clients never before reached.

The decision to in-source (DIY) or outsource is not binary. There is a spectrum from DIY to (almost) fully outsourced operations. Wealth Managers can decide where along this spectrum they wish to operate.

APIs provide the building blocks to enable Wealth Managers to assemble their own unique client experience. They can build applications that encapsulate their own techniques and intellectual property, while receiving timely updates from external providers.

Market data APIs comprise two types:

- Request/Response: As discussed in the first article in our series (https://blueconnector.co/blog/2020-06-11-wealth-management-benefits-and-risks-of-apis/), the “client” (the Wealth Manager’s system) sends a request message to the market data provider, and receives a response message. This is sufficient for on-demand queries, end-of-day processing, or infrequent requests.

- Streaming (or Event-Driven): For more frequent updates, or when Wealth Managers want to be notified of sudden changes in the market, some market data providers now offer streaming sessions that provide immediate notification of specified events, such as quotes, trades and summaries. To take advantage of this, the Wealth Manager’s systems need to be able to process these updates and flag them to the client or advisor.

Key points for the Wealth Manager to know and be prepared for:

- Obtain licence or exemption before offering services to the clients. For example a Wealth Manager in Singapore would need to obtain a Capital Markets Services licence to offer products to clients.

- Establish relationships directly with exchanges or with partners. If the product offering is equities traded on SGX or ETFs and equities on NASDAQ, then an agreement with the respective exchange is required or outsource to a partner who has it. APIs with each exchange can make access efficient.

- Factoring compliance requirements for each exchange and jurisdiction into the plan even when partnering. Some regulators have APIs for companies to connect, which could enable ease of access to latest regulatory requirements and reporting to the regulator. Note: Aspects of compliance processes can be outsourced but the responsibility to the regulator remains with the Wealth Manager.

- Capital requirements per the regulator in each country, potential margin call for delay / issues in trade settlement and the type of licence held. Whilst most market participants have stopped proprietary trading (trading on their own behalf), there are still capital requirements to be met.

Portfolio Monitoring

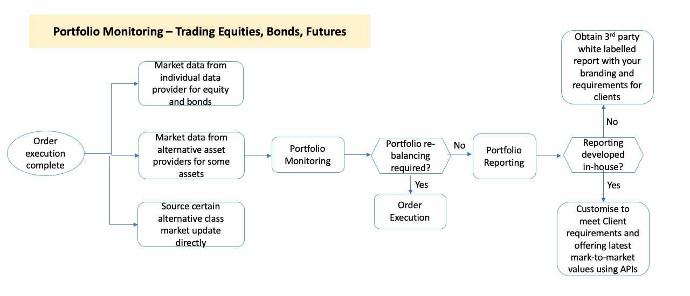

Variety of exchanges and marketplaces for sourcing data, frequency of reporting and valuation of disparate asset classes makes portfolio monitoring complex. However, there are vendors who can provide all-inclusive historical performance data across several asset classes.

The opportunity afforded by APIs is to mix and match data services corresponding to clients’ unique needs and present it in a way that draws both holistic and granular insights into their portfolio performance.

For example, some clients may be interested in intra-day movements and receiving alerts when certain trigger points are met. This can be obtained from real-time streaming APIs. Other clients may want end-of-day reports but have a complex array of investments across asset classes and geographies. Tailoring visualisations of client portfolios can differentiate a Wealth Manager from generic reporting by standard services.

As noted in our previous article on Investment Analysis and Advice (https://blueconnector.co/blog/2020-07-07-wealth-management-benefits-and-risks-of-apis-investment-analysis-and-advice/), data for traditional asset classes and for certain alternative asset classes may be available as frequently as daily or monthly. However, for certain alternative assets such as Art, Wine, and Antiques the data might remain static unless specifically valued.

Portfolio Monitoring

This illustration shows the process and decision points for effective portfolio monitoring.

In summary, the decision to partner or outsource some or most of the activities depends on what the Wealth Manager sees as their core competence and whether they have the scale (in both execution capability and client demand) to justify doing it themselves. Although a Wealth Manager may outsource certain activities, there are some that cannot be handed off.

In many cases firms will want to retain all communication with the client, as they would see client relationships as their core strength, and recognise that it is a key driver of their profitability and value-add. Some outsource providers recognise this and offer client white label communication services that apply the Wealth Manager’s branding and messaging. Additionally, regulators hold the Wealth Manager responsible - a fiduciary duty - to put their clients’ interests first; therefore, being in touch with the clients would be critical.

The key responsibilities that the Wealth Manager retains, even when outsourcing, are:

- Client relationship management, which would be part of the core activity

- Order execution accuracy and with best efforts, ultimately Wealth Manager is responsible even if orders are handed off to the third party for execution

- Updating the client portfolio

- Communicating with the client and offering new products / services

- Updates to the applications and platforms

- Protecting client data and market data

- Managing all APIs to the third party outsources

- Protecting APIs

- Data retention policy

- Audit of third party vis-à-vis your client orders and use of data

Client Offboarding

Some thought leader articles include client off-boarding as the final phase of the client lifecycle whilst others do not. For our purposes, we will include client off-boarding as a loss / churn in the final phase. Although companies prefer to obviously continue the relationship and retain client loyalty there are clients who will want to leave. Clients could migrate the portfolio to another firm or liquidate it entirely.

Key processes to capture to migrate the portfolio:

- Clients approval to send the portfolio to the fund / Wealth manager

- Client should be given details of the final portfolio balance for each investment

- Date of migration and closing out of the portfolio

To close the portfolio due to liquidation or migration either, Wealth Manager should ensure:

- Client account is deactivated

- Client data retained in one only main database for required regulatory period. Data in any other databases should be securely disposed off

- If de-activated data is accessed or used, then it needs to be in the alert reports to management as this data should not be used unless required for regulatory or legal purposes

- Final summary report and or tax reports sent to the client from a single source

Risk Management of APIs, Artificial Intelligence (AI) and Third-Party Data

In parts 1, 2 and 3 of the series of articles, we gave examples of the risks to consider. In this phase too, there are risks that the Wealth Manager should reflect on, which we highlight here. Do note this is not an exhaustive list of operational risks concerning order execution, portfolio monitoring and reporting and client off-boarding phases:

- Trading errors and escalation process. API is a tool that can enable efficiency in order execution, but the input needs to be checked for accuracy. Big losses can occur in trading errors.

- General principle of investing is buy low and sell high; therefore, if the auto-portfolio rebalancing tool is not set properly and checked then in the urgency to reduce risk for the client, Wealth Manager might actually devalue the portfolio by selling low or buying the wrong asset for e.g.

- Systems are set up to ensure client balances in the portfolio are accurate.

- Ensuring that all regulatory reporting is accurate and complete. In the event of losses or system down-time, appropriate processes are in place for reporting to the regulator as required.

- Risks to manage when off boarding the client is noted in the section above.

Conclusion

APIs can be a great tool to enable Wealth Managers to be efficient with cost, processes and time whilst allowing them to focus on their core competencies in client relationship management, diligent and responsive order execution, ongoing portfolio management and reporting. Risks need to be managed to ensure continued trusts with clients and regulators. APIs can provide Wealth Managers a competitive edge.