Meeting the demands of complex customer journeys seamlessly requires partnerships between Fintech startups, Financial Institutions, and players across eCommerce, logistics and other industries. Crafting partnerships that create value for all parties is both art and science. Research presented at IDC’s Asian Financial Congress 2018 shows that 61% of financial institutions are forming partnerships with Fintech startups. Despite this level of activity, it takes an average of 12 months to move from Proof of Concept to Market Deployment. Given than propensity to partner, it’s worth considering what makes successful partnerships, and how to craft them in a way that creates value for all, and can be executed effectively and efficiently.

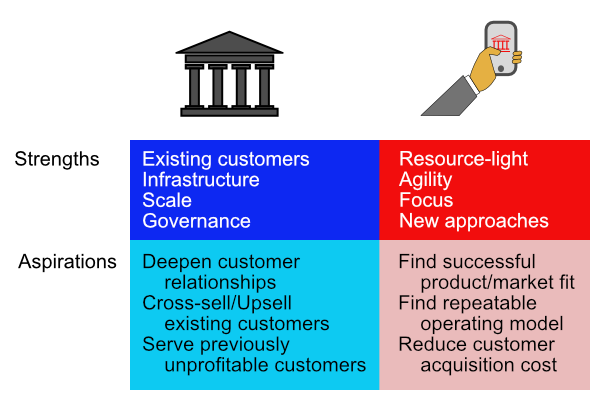

Strengths and Aspirations

From initially fearing that Fintechs would disrupt their business and disintermediate them, financial institutions have come to realise that Fintechs have strengths that can complement their own strengths.

Financial institutions (FIs) already have existing customer relationships. They have infrastructure in the form of workforce, systems, processes and robust governance at scale. They also have experience in engaging with regulators across the geographies and industry segments that they operate.

Fintechs are resource-light – they know how to get things done with the minimum of infrastructure. They are quite nimble – they can adapt and adjust quickly. Because they are small, they often focus on a specific customer problem, and they bring with them new approaches that haven’t been tried in the industry before.

They each have their own aspirations. Financial institutions want to deepen their customer relationships. They want to cross-sell and upsell wide range of products and services to their existing customers. And they want to make their operations more efficient, so they can lower their cost to serve existing customers, and to serve previously unprofitable customer segments.

Fintechs have embarked on a journey to find successful product/market fit. They are looking for a repeatable operating model. Their challenge is in finding and winning customers at a reasonable customer acquisition cost. This is where partnering with an incumbent FI becomes attractive. If it really is attractive for FIs to partner with Fintechs, if they really do have complementary strengths and aspirations, then why don’t we see more such partnerships, and why does it take so long for these partnerships to form? Well, there are challenges.

Reasons for Partnership Failure

While we are yet to see many high-profile FI/Fintech partnership failures, the dangers certainly exist. The reasons for partnership failure can include:

- Disagreements about the direction of the partnership

- Lack of value or perceived value to one or both parties, or how that value is shared

- The strain if one party disproportionately carries the burden or responsibility of providing support to customers

- Customer dis-satisfaction due to gaps or inefficiencies in the combined service offering

- Operational failure of one party, or incompatibility between the systems, processes or culture of the partners.

There is also the fear of the failure of the Fintech itself. Financial institutions are heavily regulated. They are closely monitored by regulators. They need to report, not just their activities and their financial position, but also the risk profile of their assets (loans, etc.), the risk of their operations, because they are considered systemically important to the financial services industry and the economy as a whole. Startups, on the other hand, don’t have the same level of scrutiny. Often they are not even public companies. They do not report in public forums. So the warning signs of a startup getting into trouble may not be there, or may be difficult to see.

Fintech Partnership Models

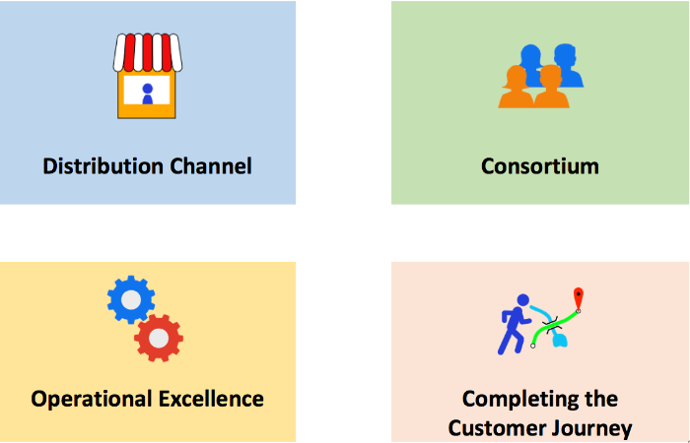

The way partnerships are formed between FIs and Fintechs tends to follow four models:

The most well established is the Distribution Channel, where either the Fintech operates as a distribution partner of the FI’s products, or the FI is a distributor of the Fintech’s products. In this situation, customers are acquired by one party, in order to sell them the products or services of the other. In this case, the party that acquires the customer will look to the product/service provider to compensate them in the form of a commission or other remuneration. For example, if a price comparison web site shows the FI’s products on its site, and a customer decides they want to purchase that product, the price comparison site will receive a commission or other form of payment for selling that provider’s product to the customer.

The second type is the Consortium. This is where multiple players are needed to make the innovation work. We see this a lot in the blockchain use cases, whether it be cross-border payments, trade finance, smart contracts or other applications of distributed ledger technology (DLT).

Many Fintechs provide solutions that aid FIs to improve their Operational Performance. These include customer analytics, Know-Your-Customer (KYC) checks necessary when customers apply for financial products, customer service, to improve the performance of an institution’s service to its customers, but also its efficiency and cost to serve, and regulatory compliance.

The other type of partnership is to help Complete the Customer Journey. Previously, an FI’s focus was on providing only those things it does well, and letting the customer figure out the rest. But customers have fairly complex needs, and have become accustomed by experience in other activities (e.g. booking flights, hotels, and rental cars from different providers on the one site) to expect a seamless experience across their needs.

Finding and Engaging Partners

So who is involved in forming these partnerships between financial institutions and Fintechs? Very early in a Fintech’s life, they seek funding from angel investors or venture capitalists. These players may introduce them to an accelerator (e.g. Startupbootcamp). An accelerator typically runs a 12-week program with a mixture of training, advice and mentoring to help a Fintech move through several stages of maturity, helping them to clarify their value proposition, even to engage customers in a feedback loop as they iteratively develop their Minimum Viable Product. An Innovation Team within an FI has a role in garnering ideas from within the firm; it may also have a talent-spotting brief to identify potential Fintech partners, and may in fact be part of an in-house accelerator program themselves. So by the time an FI gets serious about partnering with a Fintech, there are already several parties that have interacted with them. It’s important to understand the motivation and goals of each of these parties. A venture capital firm typically has an exit strategy based on a timeframe, level of growth or maturity, before they will seek to exit the relationship, so they can focus on other investments, as they often specialise in early-stage startups.

Assessment Criteria

In assessing the attractiveness of partnering with a Fintech (and vice versa), it’s important to understand what it means to customers:

- What is the problem they are seeking to solve? How does this fit with the FI’s goals, and aspirations for the relationship with their clients?

- Partner Motivation: Is the partner committed to their relationship? Are they likely to offer the same solution to the FI’s competitors? Are they seeking a long-term relationship, or is there a risk that the Fintech will later grow to a point where they seek to cut out the bank from the customer relationship?

- How will value be shared? The revenue model needs to fairly compensate each partner for the value created from the partnership.

- How will risks and responsibilities be shared? The risks, as outlined earlier, include operational failure, and regulatory or security breaches. Responsibilities for such things as customer support and sustaining operations need to be clearly defined.

- How can the customer value proposition be validated? Is it possible to create an experiment in a safe environment (a sandbox) to test market demand and prove the feasibility of the solution. Since a partnership with a Fintech will be based on a new innovation, previous market measures will not provide sufficient certainty.

The FI will also want to know about the partner’s viability. Who is currently invested in it? What are their motivations? How viable is their business model? Do they have sufficient funding to get them from their current state to a sustainable level? Are they seeking investment from the FI to help get them there?

Putting the Parts Together

When executing a partnership, the degree of integration between the FI and the Fintech needs to be thought through. Is this technology to be embedded within an institution’s premises (data centre), or will it be delivered through the Fintech’s or cloud-based systems? If the latter, then a hybrid architecture needs to be designed to enable the interaction between the partners’ systems. The Capgemini-LinkedIn World Fintech Report outlines the operating models for Fintech integration:

- White Label Solutions: Traditional financial institutions buy products or services from a FinTech firm and implement them under their own brand.

Integrated In-House Solutions: For traditional firms, this model means products and solutions are hosted in-house (typically for larger firms) or as a Software-as-a-Service (for smaller firms). - Full outsourcing: Where financial institutions outsource non-core competencies to a FinTech firm.

- API Model: Leveraging Application Programming Interfaces (APIs), a traditional firm provides APIs that enable FinTech firms to deliver various capabilities, or the incumbent uses APIs that have been offered by the Fintech firm. The API model works both ways.

- Stand-Alone In-house Solutions: Often used when a traditional firm launches a new business (such as a niche banking/insurance product), stand-alone in-house solutions leverage the Fintech partner’s technology as a stand-alone platform.

- Marketplace Platforms: Third parties source business applications from partners, FinTechs, and traditional financial services firms and provide aggregated self-service solutions over a platform, acting as integration facilitators between incumbents and FinTechs.

In making all this work, it’s important for each party to understand their own strengths, match those with partners with complementary strengths and aspirations, to build competencies to develop partnerships and integrate them, to trial solutions in a sandbox, and to know how to integrate and scale beyond that proof of concept.